Tecsys Reports Financial Results for the Second Quarter of Fiscal 2023

Revenue sets new record while SaaS revenue up 34% year-over-year

Montreal, November 30, 2022— Tecsys Inc. (TSX: TCS), an industry-leading supply chain management SaaS company, today announced its results for the second quarter of fiscal year 2023, ended October 31, 2022. All dollar amounts are expressed in Canadian currency and are prepared in accordance with International Financial Reporting Standards (IFRS).

Second Quarter Highlights:

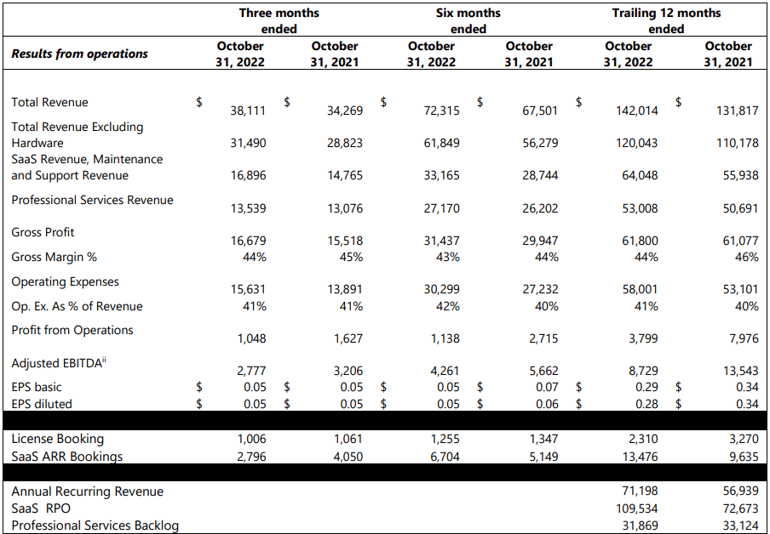

- SaaS revenue increased by 34% to $8.8 million, up from $6.6 million in Q2 2022.

- SaaS subscription bookingsi (measured on an ARRi basis) decreased by 31% to $2.8 million, compared to $4.0 million in the second quarter of 2022.

- SaaS Remaining Performance Obligation (RPOi) increased by 51% to $109.5 million at October 31, 2022, up from $72.7 million at the same time last year.

- Annual Recurring Revenue (ARRi) at October 31, 2022 was up 25% to $71.2 million compared to $56.9 million at October 31, 2021.

- Professional services revenue was up 4% to $13.5 million compared to $13.1 million in Q2 last year.

- Total revenue excluding hardware revenue was $31.5 million, 9% higher than $28.8 million reported for Q2 last year, while total revenue reached a record $38.1 million.

- Gross margin was 44% compared to 45% in the same period in fiscal 2022.

- Total gross profit increased to $16.7 million, up 7% from $15.5 million in Q2 last year.

- Operating expenses increased to $15.6 million, higher by $1.7 million or 13% compared to $13.9 million in Q2 last year.

- Profit from operations was $1 million, down from $1.6 million in Q2 last year.

- Net profit was $0.7 million or $0.05 per share on a fully diluted basis for both Q2 2023 and Q2 2022.

- Adjusted EBITDAii was $2.8 million, down 13% compared to $3.2 million reported in Q2 last year.

“We continue to see great traction across our vertical markets in the quarter with seven new logo wins as well as solid base account activity including another hospital network migration. Among the new logo wins, we added two new hospital networks, as well as North American and international logos in our converging complex distribution market.” said Peter Brereton, president and CEO of Tecsys, Inc. “In spite of challenging general economic conditions in the near term, we continue to see robust pipeline activity and strong demand. In light of this opportunity, we continue to invest to drive organic growth.”

Mark Bentler, chief financial officer of Tecsys Inc., added, “We are pleased with our Q2 performance, a record revenue quarter led by 34% SaaS revenue growth. We also crossed an important milestone this quarter in that our SaaS revenue now represents more than 50% of all our recurring revenue, and we are seeing the momentum continue with year-to-date SaaS bookings up by 30%.”

Year-to-date performance for first half of fiscal 2023:

- SaaS revenue increased by 37% to $16.8 million, up from $12.2 million the same period of fiscal 2022.

- SaaS subscription bookingsi (measured on an ARRi basis) increased to $6.7 million, 30% higher from $5.1 million in the same period of fiscal 2022.

- Professional services revenue was up 4% to $27.2 million compared to $26.2 million in the same period of fiscal 2022.

- Total revenue excluding hardware revenue was $61.8 million, 10% higher than $56.3 million reported for the same period of fiscal 2022.

- Gross margin was 43% compared to 44% in the same period of fiscal 2022.

- Total gross profit increased to $31.4 million, up 5% from $29.9 million in the same period of fiscal 2022.

- Operating expenses increased to $30.3 million, higher by $3.1 million or 11% compared to $27.2 million in the same period of fiscal 2022.

- Profit from operations was $1.1 million, down from $2.7 million in the same period of fiscal 2022.

- Net profit was $755 thousand or $0.05 per share on a fully diluted basis in the first half of fiscal 2022 compared to a net profit of $952 thousand or $0.06 per share on a fully diluted basis for the same period in fiscal 2022.

- Adjusted EBITDAii was $4.3 million, down 25% compared to $5.7 million reported in the same period in fiscal 2022.

On November 30, 2022, the Company declared a quarterly dividend of $0.075 per share, increasing the quarterly dividend from $0.07 per share. The dividend is to be paid on January 6, 2023 to shareholders of record on December 15, 2022.

Pursuant to the Canadian Income Tax Act, dividends paid by the Company to Canadian residents are considered to be “eligible” dividends.

For financial tables click here

Second Quarter Fiscal 2023 Results Conference Call

Date: December 1, 2022

Time: 8:30am EDT

Phone number: (877) 521-4127 or (416) 641-6662

The call can be replayed until December 8, 2022 by calling:

(800) 558-5253 or (416) 626-4100 (access code: 22022988)

About Tecsys

Tecsys is a global provider of supply chain solutions that equip the borderless enterprise for growth. Organizations thrive when they have the software, technology and expertise to drive operational greatness and deliver on their brand promise. Spanning healthcare, retail, service parts, third-party logistics, and general wholesale high-volume distribution industries, Tecsys delivers dynamic and powerful solutions for warehouse management, distribution and transportation management, supply management at point of use, retail order management, as well as complete financial management and analytics solutions. Tecsys’ shares are listed on the Toronto Stock Exchange under the ticker symbol TCS. For more information on Tecsys, visit www.tecsys.com.

Contact

- Public Relations: adam.polka@tecsys.com

- General Information:info@tecsys.com

- Investor Relations:investor@tecsys.com

- By Phone:(514) 866-0001 or (800) 922-8649

Forward-Looking Statements

The statements in this news release relating to matters that are not historical fact are forward looking statements that are based on management’s beliefs and assumptions. Such statements are not guarantees of future performance and are subject to a number of uncertainties, including but not limited to future economic conditions, the markets that Tecsys Inc. serves, the actions of competitors, major new technological trends, and other factors beyond the control of Tecsys Inc., which could cause actual results to differ materially from such statements. More information about the risks and uncertainties associated with Tecsys Inc.’s business can be found in the MD&A section of the Company’s annual report and the most recently filed annual information form. These documents have been filed with the Canadian securities commissions and are available on our website (www.tecsys.com) and on SEDAR (www.sedar.com).

Copyright © Tecsys Inc. 2022. All names, trademarks, products, and services mentioned are registered or unregistered trademarks of their respective owners.

i See Key Performance Indicators in Management’s Discussion and Analysis of the Q2 2023 Financial Statements.

ii See Non-IFRS Performance Measures in Management’s Discussion and Analysis of the Q2 2023 Financial Statements.