Tecsys Reports Record Revenue for the First Quarter of Fiscal 2024

SaaS Revenue Rises 44% and Total Revenue Rises 23% in the First Quarter

Montreal, Canada — September 7, 2023. Tecsys Inc. (TSX: TCS), an industry-leading supply chain management SaaS company, today announced its results for the first quarter fiscal year 2024, ended July 31, 2023. All dollar amounts are expressed in Canadian currency and are prepared in accordance with International Financial Reporting Standards (IFRS).

“We are pleased to kick off fiscal 2024 with robust results, led by 44% growth in SaaS revenue and record quarterly revenue,” says Peter Brereton, president and CEO at Tecsys Inc. “Our focus on innovation and customer-centricity has driven significant gains across key metrics, and we are seeing the impact of that in our results. This quarter’s performance sets a positive tone for the rest of the year.”

Mark Bentler, chief financial officer of Tecsys Inc., adds, “Our momentum continues with back-to-back quarters of total revenue growth of 20% or more. We are seeing positive results in our gross margin, and we've demonstrated our ability to manage costs while investing in areas that drive growth. Underpinned by a 36% increase in our SaaS RPO, we remain well-positioned for the future.”

First Quarter Highlights:

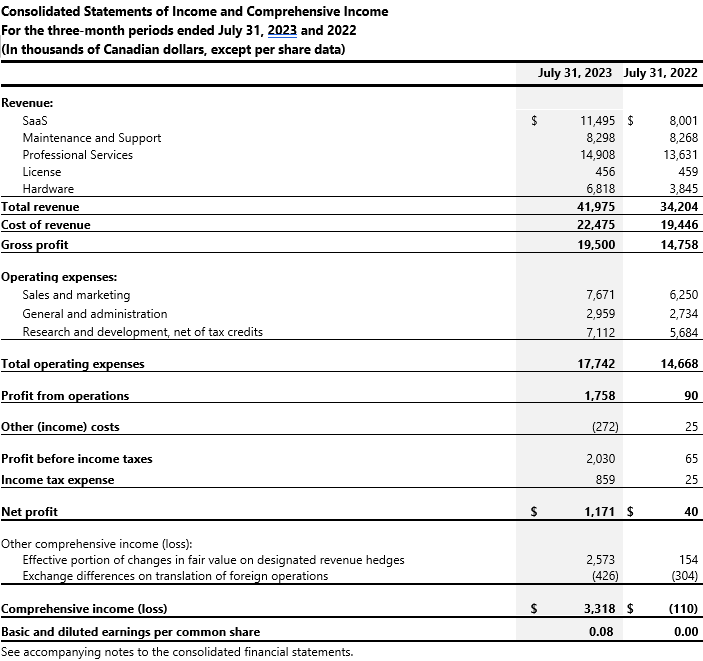

- SaaS revenue increased by 44% to $11.5 million, up from $8.0 million in Q1 2023.

- SaaS subscription bookingsi (measured on an ARRi basis) decreased by 50% to $1.9 million, compared to $3.9 million in the first quarter of fiscal 2023.

- SaaS Remaining Performance Obligation (RPOi) increased by 36% to $139.4 million at July 31, 2023, up from $102.5 million at the same time last year.

- Annual Recurring Revenue (ARRi) at July 31, 2023 was up 20% to $78.3 million compared to $65.1 million at July 31, 2022.

- Professional services revenue was up 9% to $14.9 million compared to $13.6 million in Q1 2023.

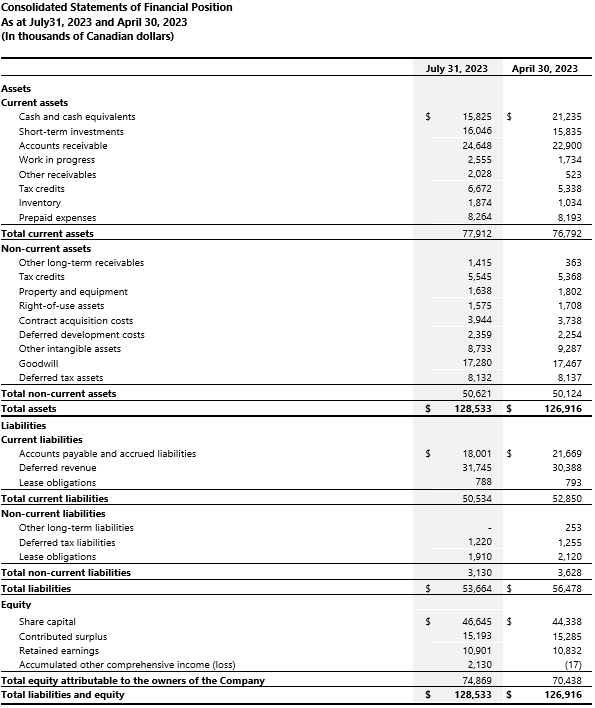

- Total revenue excluding hardware revenue was $35.2 million, 16% higher than $30.4 million reported for Q1 last year, while total revenue rose 23% to reach a record $42.0 million.

- Gross margin was 46% for the first quarter of fiscal 2024 compared to 43% for the same period in fiscal 2023.

- Total gross profit increased to $19.5 million, up 32% from $14.8 million in Q1 2023.

- Operating expenses increased to $17.7 million, higher by $3 million or 21% compared to $14.7 million in Q1 last year.

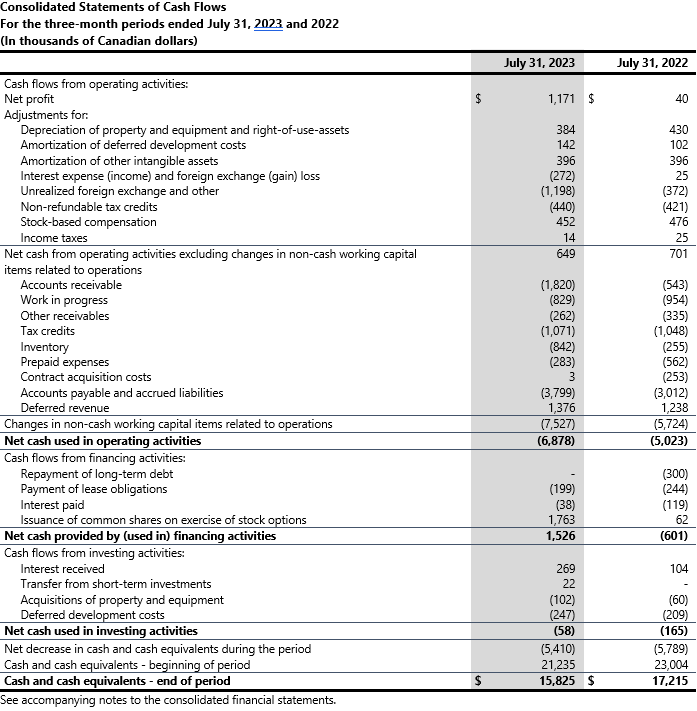

- Profit from operations was $1.8 million, up from $0.1 million in Q1 2023.

- Net profit was $1.2 million or $0.08 per share on a fully diluted basis in Q1 2024, compared to $40 thousand or $0.00 per share for the same period in fiscal 2023.

- Adjusted EBITDAii was $3.2 million, up 114% compared to $1.5 million reported in Q1 last year.

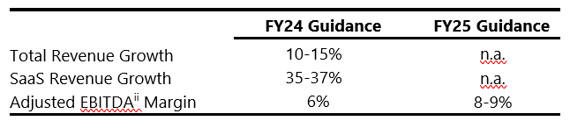

Financial Guidance:

Tecsys is reiterating previously presented financial guidance as follows:

On September 7, 2023, the Company declared a quarterly dividend of $0.075 per share to be paid on October 6, 2023 to shareholders of record on September 22, 2023.

Pursuant to the Canadian Income Tax Act, dividends paid by the Company to Canadian residents are considered to be “eligible” dividends.

i See Key Performance Indicators in Management’s Discussion and Analysis of the Q1 2024 Financial Statements.

ii See Non-IFRS Performance Measures in Management’s Discussion and Analysis of the Q1 2024 Financial Statements.

First Quarter Fiscal 2024 Results Conference Call

Date: September 8, 2023

Time: 8:30am EDT

Phone number: (877) 209-9554 or (416) 981-9007

The call can be replayed until September 15, 2023 by calling:

(800) 558-5253 or (416) 626-4144 (access code: 22027896)

About Tecsys

Since our founding 40 years ago, much has changed in the realm of supply chain technology. But one thing has remained constant; by developing dynamic and innovative supply chain solutions, Tecsys has been equipping organizations for growth and competitive advantage. Serving healthcare, distribution and converging commerce industries, and spanning multiple complex, regulated and high-volume markets, Tecsys delivers warehouse management, distribution and transportation management, supply management at point of use, and retail order management, as well as complete financial management and analytics solutions.

Tecsys’ shares are listed on the Toronto Stock Exchange under the ticker symbol TCS. For more information on Tecsys, visit www.tecsys.com.

Contact

- Public Relations: Adam Polka adam.polka@tecsys.com

- General Information: info@tecsys.com

- Investor Relations: investor@tecsys.com

- By Phone: (514) 866-0001 or (800) 922-8649

Forward Looking Statements

The statements in this news release relating to matters that are not historical fact are forward looking statements that are based on management’s beliefs and assumptions. Such statements are not guarantees of future performance and are subject to a number of uncertainties, including but not limited to future economic conditions, the markets that Tecsys Inc. serves, the actions of competitors, major new technological trends, and other factors beyond the control of Tecsys Inc., which could cause actual results to differ materially from such statements. More information about the risks and uncertainties associated with Tecsys Inc.’s business can be found in the MD&A section of the Company’s annual report and the most recently filed annual information form. These documents have been filed with the Canadian securities commissions and are available on our website (www.tecsys.com) and on SEDAR+ (www.sedarplus.ca).

Copyright © Tecsys Inc. 2023. All names, trademarks, products, and services mentioned are registered or unregistered trademarks of their respective owners.

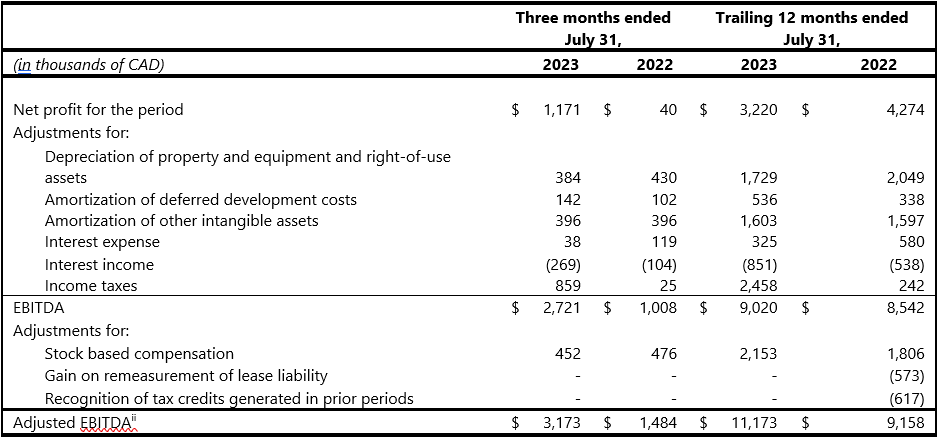

Non-IFRS Measures

Reconciliation of EBITDA and Adjusted EBITDA

EBITDA is calculated as earnings before interest expense, interest income, income taxes, depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before stock-based compensation, gain on remeasurement of lease liability and recognition of tax credits generated in prior periods. The exclusion of interest expense, interest income and income taxes eliminates the impact on earnings derived from non-operational activities, and the exclusion of depreciation, amortization, share-based compensation, gain on remeasurement of lease liability and recognition of tax credits generated in prior periods eliminates the non-cash impact of these items.

The Company believes that these measures are useful measures of financial performance without the variation caused by the impacts of the items described above and that could potentially distort the analysis of trends in our operating performance. In addition, they are commonly used by investors and analysts to measure a company’s performance, its ability to service debt and to meet other payment obligations, or as a common valuation measurement. Excluding these items does not imply that they are necessarily non-recurring. Management believes these non-GAAP financial measures, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company’s operating results, underlying performance and future prospects in a manner similar to management. Although EBITDA and Adjusted EBITDA are frequently used by securities analysts, lenders and others in their evaluation of companies, they have limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of the Company’s results as reported under IFRS.

The reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable IFRS measure is provided below.