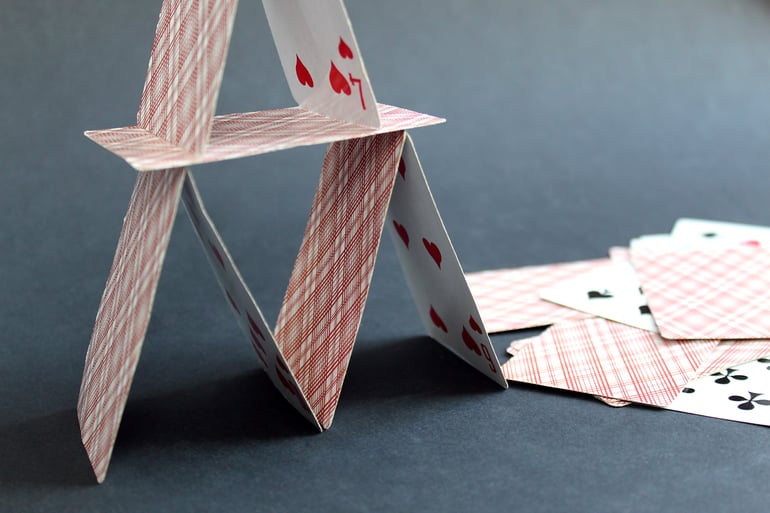

Warehouse of Cards: Solving for Fragile Supply Chains in a Fragile Economy

Fragile. This is the adjective that describes the state of our supply chains as we ever so slowly turn the page and begin writing the first few sentences of this next ‘post-pandemic’ chapter. Indeed, if the pandemic has taught us anything, it’s that supply chains are often too susceptible to disruption and too reliant on ‘business as usual’; that investments need to be made for long-term success.

But how do we square that circle as we navigate a recession that 70% of economists agree is headed our way in 2023? Guy Courtin and I sat down with Mark Bentler, chief financial officer at Tecsys, to discuss ongoing economic volatility, a possible recession and how these conditions are likely to impact distribution and supply chain-oriented businesses. We explore ways to shore up a strategic defense against this new layer of supply chain disruption.

A New Deal

Just like a house of cards, supply chains around the world have relied on the balance and stability of the structure around them, each link contributing to the overall system. When one link fails, it compromises the entire construct. Indeed, the pandemic exposed weak points in nearly everyone’s supply chain.

And if the pandemic shook the foundation, a recession would be a gust of wind.

The foremost lesson that emerged from this conversation with Mark and Guy is that it is worth the investment of time to understand the cards you’ve been dealt and get a sense of where the risks and opportunities exist. Reinforce the cracks from the stress tests of the pandemic and invest in your capacity to keep up with the rebound that will come.

Guy calls this process a ‘supply chain audit.’ It is an end-to-end assessment of every component of the supply chain network with the end goal of identifying areas of concern. For example, “If I'm single sourcing an item and it's for one of my top ten products and I know that that supplier is at risk and I don't have […] a substitute [this would be] a red flag,” he explains.

“The chain is only as strong as its weakest link, but you kind of have to poke around and get into the details to figure out where those weakest links actually are,” adds Mark.

Only with that information in hand are you able to stack the deck in your favor.

Stack the Deck

There are several proactive measures that supply chain organizations can take to hedge against the kinds of disruptions we are facing.

“It’s going to take some vision and some backbone to come out of a recession stronger than how you came in,” says Guy, because in the face of an economic slowdown, the gut reaction is to cut costs and hunker down.

“For [businesses] where just survival isn’t a concern, there are many approaches that can get something accomplished [like] process and systems redesign that will make the business ready to scale and even more efficient when inevitable growth does return,” says Mark. Other approaches discussed by Mark include diversification of supply so that regional bottlenecks don’t throttle operations, as well as a generational shift toward local buying preferences. Across the board, Mark highlights the importance of context, a globalized perspective and risk mitigation, and the guiding factors in setting yourself up for success.

Follow Suit

It’s important to consider the impact of economic disruption on your specific industry. If your business is distributing to restaurants, for example, you’ve been punched in the nose for the past two years, and now you’re looking at a negative impact to discretionary spending for the consumer. Mark admits those businesses may indeed be “hunkering down and hanging on, hoping that they can make it through.”

On the other hand, there are other industries less affected by the economic cycle. “People are still going to be sick, and they're still going to need care. And those hospitals are still going to need to operate,” explains Mark, noting that the trajectory of “let's go fix the supply chain” is probably not going to be impacted by what would otherwise be the dark clouds of recession.

Raise the Stakes

A recurring theme of our conversation was this idea that the pandemic accelerated digital adoption to the point where supply chain organizations were struggling to ramp up operations to meet heightened consumer expectations. And now, amidst a labor crisis and supply chain disruption in spades, we are facing a potential discretionary spending slowdown.

Supply chains can’t catch a break.

However, Mark proposes that a slowing economy may in fact be the exact break supply chain organizations need to retool. “Does an economic slowdown actually create some breathing room?” Mark asks. “Does an economic disruption create the calm that allows time to invest in supply chain?”

Mark explains how this is a pivotal time for organizations to catch up on the supply chain transformation they’ve been backburnering for too long now.

“Most of the businesses that are out there, supply chain is critical to their success but they're still operating on systems that they probably acquired back before the dot-com bust around Y2K,” he explains. “Supply chains are different now than they were 20 years ago. The ability to be able to pivot and be resilient and efficient and agile in supply chain has never been anywhere near as important as it is right now.”

Then everything went on pause when COVID hit, Mark explains. “But COVID actually sent into overdrive their requirement to be agile. As more shopping moves online and you start to look differently at how systems need to operate to support fulfillment and next-day delivery, all this stuff just changes dramatically. So now that asset that you've been sweating for 20, it just got a lot older in the last two years.”

The message was clear: An economic slowdown could very well be the opportunity for struggling organizations to make significant improvements to their supply chain operations through savvy investment.

The Wildcard

“I think there are some pretty big questions on the horizon,” Mark acknowledges in our conversation, but he offers this key word of warning: “If a recession comes and that throws you off, you might not have an ‘after recession’ period of time, and it’s maybe too late for you; the investment may need to be happening now and I think that's something that businesses are considering as they look at things like security and agility. I think that will make big businesses decide that it's time to roll up their sleeves and get into some investment.”

Those organizations that are able to audit, plan and invest strategically will hold a winning hand when the time is right.